Crypto Comeback Pro is a crypto trading tool for investing in the crypto market with an %88 average win rate on trades and is the #1 trading software for crypto traders from all around the globe in 2022. Try it For FREE Today.

Copy Trading Intro

Copy trading is a popular tactic used by many traders to replicate experienced traders and follow their strategies. By properly copying the trades of a variety of successful traders, you can potentially increase your chances of making profitable trades without having to spend a lot of time analyzing the market yourself. This can be particularly useful for new traders who may not yet have the knowledge or expertise to make informed trades on their own, or for experienced traders who may not have the time to commit to the market.

What are Some Advantages of Copy Trading?

There are several benefits to copy trading. For one, it can be a great way for new traders to learn from more experienced traders and gain valuable insights into different strategies. It can also be a convenient way for traders to diversify their portfolio and potentially increase their profits without having to spend a lot of time and effort on market analysis.

However, it’s important to note that this type of trading comes with some risks. As with any investment, there is no guarantee of success, and you should carefully consider whether this strategy is right for you. It’s also important to do your due diligence and research the traders you are considering copying, to ensure that they have a track record of success and use strategies that align with your own risk tolerance and investment goals.

How Do People Perform Copy Trading?

In copy trading, trades are automatically copied from a signal provider to a follower’s account. This is typically done through the use of high-end software technology that is designed to replicate trades in real-time. Mirror trading is a hands-off approach to trading that allows traders to simply choose a signal provider and let the software do the rest.

Is Social Trading the Same as Copy Trading?

Social trading is a more interactive form of copy trading that allows traders to connect with and follow the trades of other traders on a social trading platform. In addition to copying trades, social trading platforms often provide features such as forums, social features like chat rooms etc. that allow traders to share ideas and insights with one another.

Overall, both mirror trading and social trading can be useful tools for traders looking to take advantage of market opportunities without having to do all of the research and analysis themselves. However, it’s important to remember that there are risks associated with both approaches, and it’s important to carefully consider whether either of these strategies is right for you before diving in.

Is Mirror Trading and Copy Trading the Same?

Mirror trading and copy trading are both forms of automated trading that allow traders to replicate the trading strategies of other traders. The main difference between the two is that mirror trading involves copying specific trading strategies that are often implemented through automated algorithms, while copy trading involves copying the individual trades of other traders.

Mirror trading can be a useful tool for traders who want to diversify their portfolio and potentially increase their profits without having to do all of the research and analysis themselves. However, it’s important to keep in mind that there are some risks with any form of automated trading, which is why you must be careful before getting started.

Is it Possible to Copy Trade Crypto?

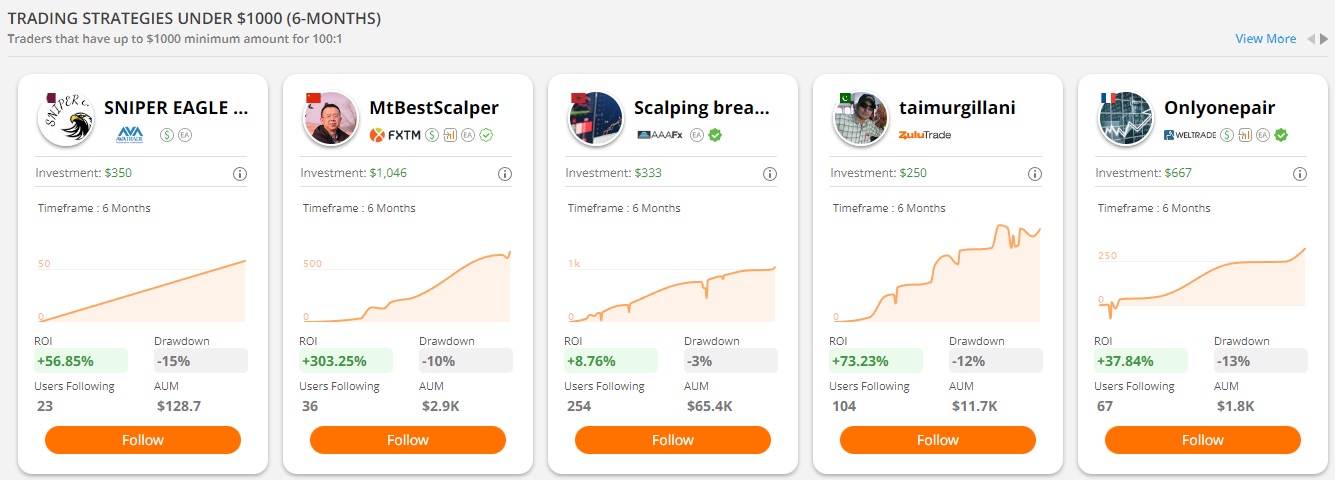

Copy trading in the cryptocurrency market works in much the same way as it does in other financial markets. Traders can choose to follow and replicate trading strategies from other traders through a copy trading platform. These platforms typically offer a variety of features, such as the ability to filter through the trading results of different traders, choose the amount of capital to allocate to a specific trader, and set risk limits per trade.

One important thing to consider when copy trading cryptocurrencies is to research the traders or trading strategies that you are considering following. It’s important to choose traders or strategies that have a proven track record of success and that align with your investment goals and risk profile. You must also remember that copy trading, like any form of trading, has some nuances and particular aspects, which you must familiarize yourself with before you begin your journey.

What are Some Pros and Cons of Copy Trading

Copy trading can be a useful tool for traders looking to take advantage of market opportunities without having to do all of the research and analysis themselves. However, it’s important to consider both the pros and cons of copy trading before deciding whether it’s the right approach for you.

Some of the main pros of copy trading include the ability to automate your trading and the simplicity of finding profitable traders to follow. It can also be a helpful way to avoid the negative impact of emotions on trading, since you don’t have to make trades on your own.

On the other hand, one of the main cons of copy trading is that you are at the mercy of the traders you follow, and if they make a bad trade, it will also appear in your account. However, most copy trading platforms allow you to set risk limits and allocate a specific amount of capital to each trader, which can help you to mitigate this risk. It’s also possible to interfere and manually close a trade if you feel that it is not a good decision.

Final Thoughts

With so much to offer, there is no wonder why so many people have started copy trading instead of doing it all by themselves. Since many people simply do not have the time to focus on creating a trading strategy, following winning tactics by experienced traders seem like a wise choice. Sure, there may be some risk involved but if you choose the trader you want to follow carefully, you can breathe easy knowing that you will be in safe hands. It would also help to make sure that you have enough backup in case things do not go your way.

Deep Into Blockchain is not responsible for the content, accuracy, quality, advertising, products or any other content posted on the site. Some of the content on this site (namely Branded Content Posts) is paid content that is not written by our authors and the views expressed do not reflect the views of this website. Any disputes you may have with brands or companies mentioned in our content will need to be taken care of directly with the specific brands and companies. The responsibility of our readers who may click links in our content and ultimately sign up for that product or service is their own. Cryptocurrencies, NFTs and Crypto Tokens are all a high-risk asset, investing in them can lead to losses. Readers should do their own research before taking any action.